Common Questions About Hiv

Here are some of the most common questions that people ask about HIV and what people want to know about living with the disease.

How long can you live with HIV? The average life expectancy for someone who is HIV positive has increased dramatically over the past 20 years, since the introduction of HAART medication. In 1996 the life expectancy for someone diagnosed with HIV at age 20 was 39 years of age, this has increased to age 70 years in 2011, so over 30 years longer.

What are the 4 main stages of HIV infection? If HIV remains untreated then the virus will go through 4 main stages which include:

- Seroconversion illness is the short period after contracting the virus where you might show similar symptoms to the flu

- The asymptomatic stage follows the seroconversion period, which is where the virus is infecting new cells in the body, making copies of itself, and weakening your immune system. Most people wont show any symptoms at this stage of the virus

- Symptomatic HIV is one of the later stages where HIV treatment needs to be introduced to reduce the impact on your weakened immune system

- Late-stage HIV is where HIV has had the chance to cause severe damage to your immune system and can allow other infections to develop such as pneumonia, tuberculosis , and even cancers

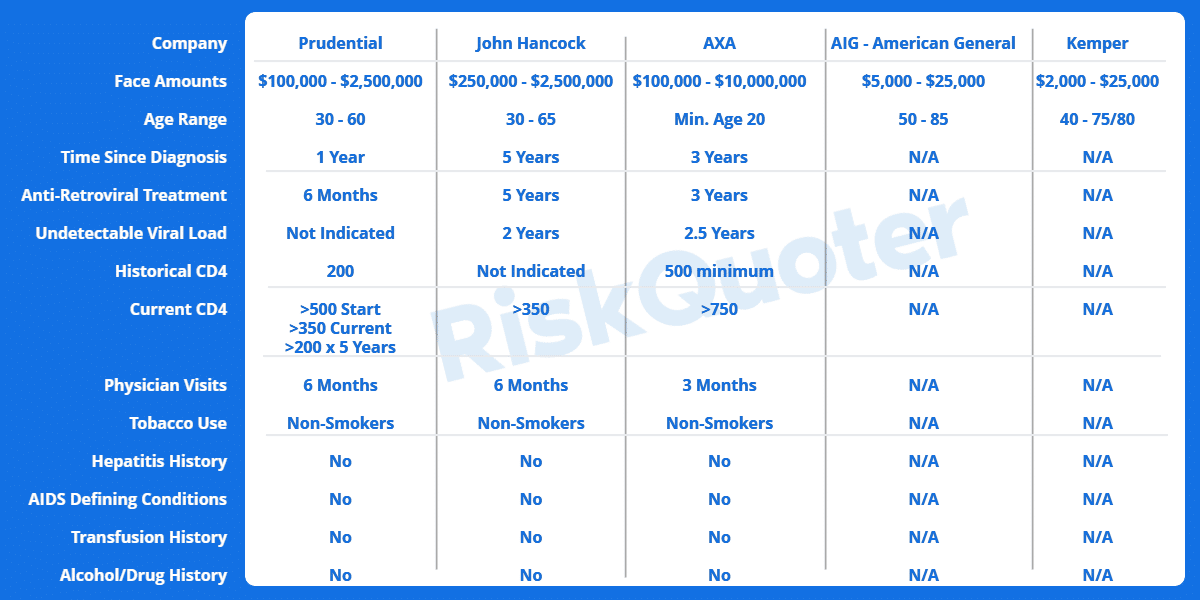

A Handful Of Companies Offer Term And Whole Life

In the 1980s, a diagnosis of AIDS, the disease caused by HIV, meant an average life expectancy of one year, and insurers shied away. Today, medical treatments can prevent most HIV cases from progressing to AIDS.

HIV is much more understood than when it was first discovered in the 1980s, Chris Abrams, a life insurance agent and founder of Abrams Insurance Solutions in California, said by email. Abrams says he has helped HIV-positive clients purchase policies from American National, John Hancock and Prudential.

Guardian Life also recently opened the doors to HIV-positive people. Healthy individuals living with HIV now have access to both whole life and term life, according to Mark H. Lewy, Guardians chief medical director.

The COVID-19 pandemic has slowed approval in some cases, Abrams says, but it has not stopped insurers from writing new policies for people with HIV. I just had an HIV- client approved last week.

Is A Urine Test Part Of The Medica Exam

In addition to undertaking the general medical tests, life insurers also carry out a urine test. This helps to detect some health complications, such as cholesterol, STDs and HIV and AIDS, among others. A medical practitioner can identify signs or symptoms of certain diseases just through a little urine test.

Also through a urine test, it is easy to tell whether or not a person takes any drugs. Cocaine or marijuana takers can easily be identified through urine examination. In essence, a life insurer would want to test your urine to check if there are any health issues or check if you use any drugs.

Don’t Miss: Can You Get Hiv From Positive Undetectable

Factors Which Will Impact Your Coverage

Whenever a life insurance company underwrites a policy for a new customer, their main goal is to assess how much of a risk they are undertaking in insuring them.

To do so, they take into consideration your health, age, and lifestyle, looking to any factors which might increase their risk of paying out a policy.

The same is true when you have been diagnosed with HIV, in addition to a few specific considerations:

- Your overall health: Like any applicant, your health will be assessed. With any pre-existing condition, underwriters look to determine how you manage your illness, getting an idea of how well you are able to function with it on a day-to-day basis.

- Your age: As is the case with traditional applicants, your age will be considered when calculating quotes, weighed differently depending on the company and type of policy you seek.

- Other conditions: If you suffer from any other serious health conditions, it may impact your rates and general access to coverage.

- Treatment: With specific regard to your diagnosis, the insurance provider will look to the treatment of your condition. While your condition may be incurable, its treatability can help your likelihood of getting covered.

- Progression: Essentially, the further your illness has advanced, the less likely you are to access a traditional life insurance policy. If your HIV infection has progressed to AIDS, you may not be able to qualify for traditional coverage.

How Does A Life Insurance Health Exam Work

Generally, your medical examiner, sometimes called a paramed, will ask questions about your medical history. He or she may also take height and weight measurements, and a blood and urine sample. Plan for the appointment to run 30 to 45 minutes.

What are the medical tests done for term insurance? Your exam could include the following:

You May Like: How Many New Hiv Infections Per Year In Us

What Else Should I Expect From The Blood Test And Medical Exam

Medical exams for insurance companies are usually handled by third party health companies that specialize in offering exams. You can schedule the exam at a time that works for you, and they can conduct it at your home or office. In some cases, you may also be able to go to a local testing center for your exam. During the medical exam, they will first check your drivers license to confirm your identity, and then youll be asked a series of health questions. These questions usually confirm any information you included in your initial application, as well as information about your current physician and medical care.

Then, you will be asked to take a blood and urine sample. They will also take your pulse and blood pressure and measure your height and weight. This process rarely takes more than half an hour. In some cases, you may be required to do an EKG as well, which adds a little bit of time to the procedure. This is usually only included in the exam if you want an unusually large death benefit. Afterward, they will submit the results to your insurance company. Its also important to request a copy of the results, just in case theres any conflict or confusion you need to address.

How Do You Know If The Company Is Testing For Hiv

It is your right as an applicant to know what an insurance company is using your bodily fluids for when you submit to testing. This is why you are required to sign a thick pile of paperwork before the company will order any medical records or send a paramedical professional to you to collect samples. It is very important to read through these papers so that you know what you are approving.

It is not against the law to test an applicant for HIV or to ask an applicant if they are HIV-positive as long as the applicant signs a form where they give their consent. Remember that the actual laws surrounding HIV testing vary from state to state, but testing is a common practice in the life insurance industry and all companies have consent form requirements. If you refuse to sign a consent form it is quite simplethe company refuses to issue you a policy. Make sure that you read through all of the forms that you are signing and ask for lab results to be given to you if you would like to review them with your doctor as well.

Recommended Reading: Where Do I Get Tested For Hiv

Questions And Procedures During A Life Insurance Medical Exam

A few questions often asked during the medical exam include:

- Your medical history including any hospitalizations, medications, procedures you have had, or conditions. You will be asked a series of questions to make sure you did not forget to mention anything and to give you the opportunity to reveal your full history.

- Your families medical history

- Name, address, phone number for your primary doctor as well as any other doctors who you have visited in the past few years for special consults or medical situations. Have all these contact details handy.

- Lifestyle habits such as smoking, drinking, recreational drug use, and exercise

- How much life insurance you are interested in purchasing

- If you suffer from any conditions like depression or anxiety and if you have been hospitalized for any condition you say that you have

There are also a few procedures to expect during the exam:

Life Insurance For Hiv Positive Applicants

It wasnt that long ago when individuals who were HIV-positive could forget about getting life insurance. Its interesting, however, that the folks who understand the need for life insurance the most, either face stiff challenges buying it or cant get it at all.

The good news is that the life insurance industry has opened up somewhat for individuals who have tested positive for HIV.

Also Check: What Is The Treatment For Hiv Aids

Some Policies Offer Guaranteed Coverage

If a person with HIV cant get a standard policy, other options may be available.

Many employers offer group life insurance as a benefit to employees, and it typically doesnt require a medical exam. Group policies are the best opportunity for anyone with HIV, says Hallett. He recommends maxing out any group life insurance thats available without health questions, often one to three times an employees salary.

Guaranteed issue life insurance is another possibility. These policies typically are limited to people 45 and older, and death benefits may not pay out within the first two years of the policy. Coverage amounts are generally low, often $25,000 or less, but Hallett notes these policies are stackable you can buy policies from a variety of life insurers to grow the total death benefit.

The Health Insurance Portability And Accountability Act

In 1996 the federal government passed into law the Health Insurance Portability and Accountability Act . HIPAA law provides eligible individuals who have recently lost their employer-sponsored group health insurance the opportunity to purchase health insurance coverage even if they have a preexisting health condition, which includes treatment for AIDS or ARC. If you meet the definition of an eligible individual, all health insurance companies and health plans that sell individual coverage must offer you health insurance regardless of your medical history. This requirement to issue insurance is called “guaranteed issue.” In order to qualify as an eligible individual, you must meet the following conditions:

- Your last health care coverage must have been under an employer sponsored group health plan, which includes COBRA or Cal-COBRA continuation coverage, for at least 18 months. This prior 18-month coverage is referred to as “creditable coverage.”

- All available COBRA or Cal-COBRA continuation coverage has been elected and exhausted. If you qualify for COBRA or Cal-COBRA you are required to accept the coverage and continue the coverage for the maximum time period allowed .

- You are not eligible for coverage under a group health plan, Medicare, Medi-Cal, and /or do not have other health insurance.

- You did not lose your most recent health coverage due to nonpayment of premium or fraud.

You May Like: Can Mosquitoes Give You Hiv

What You Need To Know About Health Insurance

When applying for health insurance, an insurance company may ask questions regarding your medical history to help determine coverage eligibility. Medical records from your physician may be requested as part of the underwriting process. Insurance companies rely upon accurate information to make their underwriting decisions. If the insurance company discovers that you did not accurately report your medical history on the application, your policy can be canceled or rescinded.

A health insurance company cannot require you to disclose your HIV status or to take an HIV test as part of the application process . However, it can ask if you have received medical treatment for AIDS, AIDS-related complex , or an immune system disorder other than HIV/AIDS. It may also ask you if you are taking or have taken HIV/AIDS medications. Since HIV infection is not a diagnosis of AIDS or ARC, a health insurer cannot deny health coverage solely because an applicant is HIV positive. If an applicant has been treated for AIDS or ARC, a health insurer can deny coverage based on a preexisting medical condition. CIC Section 10291.5 requires that all applications for health insurance prominently display the following notice: “California law prohibits an HIV test from being required or used by health insurance companies as a condition of obtaining health insurance coverage.”

More Options Could Be On The Horizon

Medical and legal developments indicate more life insurance options could be ahead for people living with HIV.

In January, the U.S. Food and Drug Administration approved a monthly injectable treatment for HIV, an alternative to the often forgotten daily medication of ART. Since insurers require years of consistent adherence and doctor supervision before coverage begins, a monthly treatment could help more people qualify.

And starting in 2023, California insurers wont be allowed to deny life insurance or disability income insurance based solely on an applicants positive HIV test. Gov. Gavin Newsom signed the Equal Insurance HIV Act in September.

But the new legislation doesnt mention decreasing the cost for people living with HIV. While I obviously applaud the move to provide life insurance to people living with HIV, says Schoettes, what we really need is … to get it to a place where its no longer discriminatory in its pricing.

About the author:Ben Moore is an insurance writer at NerdWallet. Read more

Don’t Miss: Which Is The Main Goal Of Hiv Treatment Brainly

Office Of Aids And The Aids Drug Assistance Program

The DHS also operates the Office of AIDS for California residents. The Office of AIDS creates educational materials and compiles statistical information regarding HIV/AIDS. Their efforts target publicly-funded HIV/AIDS care and treatment programs and critical prevention strategies aimed to interrupt HIV/AIDS transmission. The AIDS Drug Assistance Program falls under the control of the Office of AIDS.

The ADAP was established in 1987 to help provide HIV/AIDS drug therapy access to individuals who are uninsured or underinsured of low-to-moderate income levels. ADAP is a state prescription drug program that is jointly funded by Ryan White CARE legislation and state funds. The goal of the ADAP is to make available drug treatments that can reliably be expected to increase the duration and quality of life for those living with HIV/AIDS. For ADAP eligibility requirements, please refer to the “Resources” section for contact information.

After The Life Insurance Health Exam

Once youâve completed your health exam, it takes about five to seven business days for your results to come in. After the underwriters have received and looked over your info, theyâll either reach out with additional questions or requirements, or youâll receive a final decision. If that includes an offer for coverage, youâll receive your confirmed price, along with any other relevant information. In most cases, you can request a copy of your health exam results for your own records, too.

If your term life insurance policy includes a provision that allows you to convert to a whole life insurance policy without additional underwriting, then you shouldnât need another health exam to do that conversion. In that case, your insurance company should be able to use your original health exam.

Don’t Miss: How Long Can Hiv Lay Dormant

What Happens During The Medical Exam

During or after your initialphone interview, the underwriter will work with you to schedule the medical exam at a convenient time.

Getting a life insurance medical exam is similar to going to your doctor to get a physical. However, life insurance companies work with you to accommodate your schedule, and you can choose to have a medical technician come to your home or work. Normally, the whole process takes about 30-45 minutes and includes two parts:

A verbal questionnaire where youâll answer a series of questions about your health, lifestyle, and social habits.

A physical exam in which the examiner will measure your height and weight, check your blood pressure and collect blood and urine samples.

During the verbal portion of the exam, the tech will ask you a series of health-related questions to help the insurer confirm the information on your application. Expect questions about the kinds of prescriptions youâre taking and which doctors youâve seen recently. This is usually where the medical examiner gets a full scope of your health, so donât lie or withhold information during your initial interview.

During the medical exam, the technician performs routine health checks you would expect from your regular doctor at an annual physical. That means checking your pulse, blood pressure, and using your height and weight to figure out yourbody mass index, as well as providing ablood test and urine sample.

Group Term Life Insurance

Group life insurance is a type of life insurance policy that is offered by employers and doesnât require a medical exam â or even an initial interview.

The downside of group life insurance is that it usually doesnât offer enough coverage and often needs to be supplemented with a traditional life insurance policy. And, if you leave your job, the coverage wonât go with you.

However, some life insurance is better than none, and if you need to skip the medical exam, a policy guaranteed by your employer can at least offer some financial security for you and your loved ones.

Recommended Reading: Can You Get Hiv From Dried Blood

Should I Tell The Life Insurance Company I Am Hiv Positive

The only time you should disclose any personal information is when the life insurance company requests the release of that information.

Unless they ask you about HIV, AIDS, or health-related issues, you do not need to volunteer information or disclose your health status to an insurance company. But, understand there may be catch-all questions, in which you will.

However, you must be truthful when asked any health questions during your medical exam for HIV life insurance. In addition to avoiding insurance fraud, most life insurance companies have a contestability clause in their contracts.

This means that, for two years after your policy is purchased, your insurer has the right to cancel your policy or challenge a claim if it is determined you misrepresented your condition.